World Heart Day: a global call to heart health

September 29, 2024 / Arrhythmogenic Cardiomyopathy and its impacts

World Heart Day, celebrated annually on September 29th, aims to raise public awareness about cardiovascular diseases (CVDs), their prevention and global impact. As the largest global campaign promoting cardiovascular health, the day highlights the importance of heart care and encourages people around the world to adopt healthier lifestyles.

One major cardiovascular disease being highlighted is Arrhythmogenic Cardiomyopathy (ACM). ACM is a genetic disorder marked by the progressive loss of cardiomyocytes, heart muscle cells, and their replacement by fibrous or fatty tissue. This condition can lead to dangerous heart rhythms known as ventricular arrhythmias, and sudden cardiac death, particularly in young individuals and athletes. With an incidence of 1 in 5.000, ACM remains a serious cardiovascular condition for which there is currently no cure.

Current treatment options for ACM are limited and focus on symptom management and prevention. However, despite these measures, the risk of sudden cardiac events remains difficult to predict, and complications are relatively common. Recent research has shed light on the role of fibroadipogenic precursors (FAPs) in the fibrofatty remodelling seen in ACM. These findings suggest that targeting these pathways may offer new therapeutic avenues for ACM.

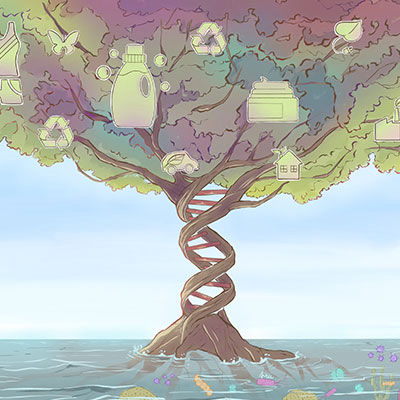

The IMPACT project (Cardiogenomics meets Artificial Intelligence: a step forward in arrhythmogenic cardiomyopathy diagnosis and treatment) aims to improve our understanding of ACM by combining large-scale genomic, proteomic and instrumental data from patients with structural and functional studies in laboratory settings, using 3D microtissue and in vivo models. The project’s goal is to establish a clear connection between genetic mutations and the clinical manifestations of ACM. Understanding these genotype-phenotype relationships could lead to more accurate risk assessment, improved disease management and the development of novel therapies for ACM. The project’s outcomes will pave the way towards novel therapies for ACM.

As we celebrate World Heart Day, it's important to highlight the importance of continued research and public awareness in combating cardiovascular diseases such as ACM. By encouraging heart health and supporting scientific progress, we can work towards a future with better prevention, diagnosis and treatment options for all cardiovascular diseases.

by ilaria.spreafico

Share This Page!